f.a.q.

You have questions. wE have answers.

Here are the answers to some common questions about investing in a real estate syndication to help you navigate the intricate world of property investment with clarity and confidence.

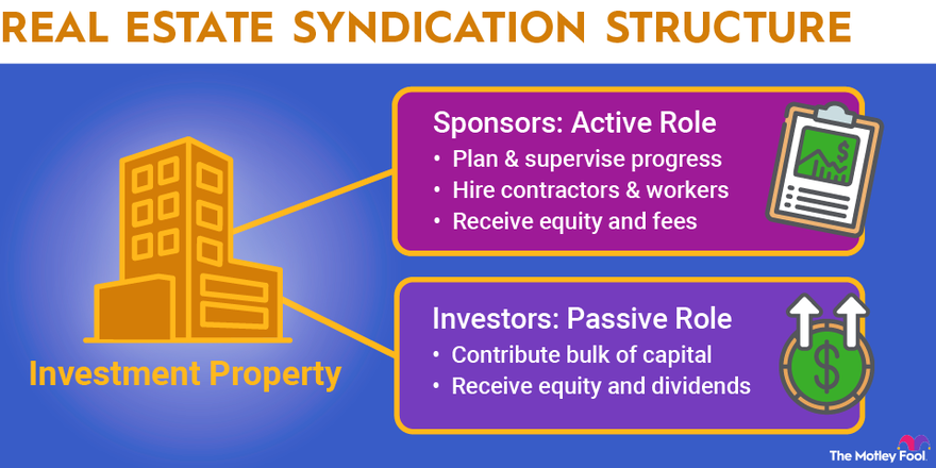

When investing in a complicated asset classes like multiple multi-family homes, a top-tier operator can bring great value to the opportunity — enough that they should make up the fact that they’re receiving some of the proceeds of the offering.

- The more complicated the investment vehicle, the more value an operating partner can bring to the table. In a relatively simple asset class like single-family residences, or fix and flip, there isn’t a substantial difference between best-in-class owners and mom-and-pop owners. Therefore, an operator isn’t as valuable. However, in a 20+ unit multi-family apartment portfolio, which functions more like an operating business, an operator can provide invaluable systems, processes, relationships, and know-how, justifying their participation in the offering. Because of this, the return profile might actually be similar to what an active investor may achieve on their own, but the passive approach doesn’t require the investor’s time once the investment has been made. To me, this is the strongest case to be made for passive investing.

- The passive approach allows investors to experience diversification across multiple geographies, tenant types, product types, management styles, operators, and many more aspects of the real estate sector. One can’t be an expert in everything. Diversification, however, is critical when building a portfolio. From our perspective, the only way to achieve this goal is to have a portion of their portfolio invested in passive investments that are managed by leading operators in a particular asset class. As a tie-in to #1 above: Even if the potential investor has had success owning and operating real estate in more complicated asset classes, it’s very likely that they’re either over-allocated to that particular asset class or don’t have a significant market advantage in the asset class because they aren’t exclusively focused on it.

- Due to the distinction between the class of shares between the General Partner (operating partner/sponsor) and the Limited Partner (passive investor), the sponsor is the only party to incur credit and liability risk.

This is a major value-add for passive investors because it grants them access to low-cost debt financing through the sponsor’s track record without incurring the risk associated with personally guaranteeing a loan.

Eliminating these challenges of investing in real estate categorically shifts the total risk profile of the investment without ever significantly deteriorating the returns. - Investing in passive syndications allows investors to rely on highly sophisticated operators who stand to gain millions of dollars if they’re able to deliver to their investors. This is in stark contrast to typical active investments, where the property values are limited because the investment capital is generally all coming from one person. High-value commercial properties with the potential of producing millions of dollars’ worth of gains not only attracts high-caliber people, but also genuinely aligns the interest of the operating partner and the investor. Unfortunately, this often isn’t the case in single-family houses, where investors may worry about fraudulent property managers who skew invoices in hopes of skimming a few hundred dollars.

Ultimately, passive investors are relying on the operating partner’s expertise. If the passive investors in a deal retain significant voting rights, they’re allowing their investment capital to be controlled by other passive investors whom they know very little about and who are likely not experts when it comes to this particular investment. So it makes sense that most passive syndicated investments don’t allow investors many voting rights.

Accordingly, the overwhelming majority of a passive investor’s due diligence process will be focused on the operating partner, and they’ll have very little insight into the other passive investors in the offering.

Here’s an extreme example: Let’s say there is an offering where the operator is raising a total of $2,000,000. In this scenario, let’s assume that one passive investor invests $50,000 and another investor invests the remaining $1,950,000. If the operating agreement grants the passive investors a significant amount of control via voting rights, and their vote is based on their proportional investment amount, the $50,000 investor’s entire investment is subject to the whims of another passive investor whom they likely know nothing about.

Furthermore, the general public tends to make the wrong decisions during stressful times. For example, if the market starts to slide, you don’t want the other passive investors forcing the operating partner to sell. This is just one reason why it’s usually best to defer to the operating partner to make tough choices, if they have to be made.

We know this may seem counter intuitive, but it’s better to limit the voting rights of the passive investors to action items like the removal of the manager or raising additional capital for unexpected improvements to a property.

One legal provision we include in our operating agreement is that we grant the General Partner (GP) of the offering a Right of First Refusal to purchase the shares of any investor who wishes to sell their interest without notifying all of the other investors.

This way, the problem can be solved while also limiting the amount of time it takes to complete the transfer.

It’s important to reiterate to the potential investor that this provision doesn’t set the expectation that the GP will purchase the shares; it’s just the first line of defense for resolving the situation. In our offering documents, if the GP decides not to purchase the shares, the next step is to sell the shares to another investor who’s already in the offering, which decreases the amount of administrative duties related to completing the transfer.

No. At this time Granite State Property Partners only works with accredited investors. An accredited investor is an individual or entity that meets specific financial criteria, allowing them to invest in private securities not registered with financial authorities, such as the U.S. Securities and Exchange Commission (SEC). The criteria are intended to ensure that only individuals or entities with sufficient financial knowledge and resources can take on the risks associated with these investments.

In the U.S., an accredited investor typically meets one of the following criteria:

1. Income: An individual must have an annual income of at least $200,000 (or $300,000 jointly with a spouse) for the past two years, with a reasonable expectation of maintaining the same income level in the current year.

2. Net Worth: An individual must have a net worth exceeding $1 million, either individually or jointly with a spouse, excluding the value of their primary residence.

3. Entity Requirements: Certain entities, such as banks, insurance companies, trusts, and partnerships, qualify if they have assets exceeding $5 million or if all owners are accredited investors.

This designation allows accredited investors to participate in private placements, hedge funds, venture capital, and other high-risk investment opportunities.