Mailbox Money

Owning quality multi-family properties can lead to a pleasant experience: money arriving directly in your mailbox. Investors affectionately term this phenomenon as ‘mailbox money’.

Leveraged Growth

Capital appreciation hinges on the overall value of the property, rather than solely on your initial down payment. In essence, you’re potentially earning 7% on a $600K asset instead of just a $150K investment, fostering accelerated growth for your capital over time.

the Tenants pay

Over time, your shares in the LLC will be worth more and more, as the tenants pay down the mortgage on the properties it owns, rather than you.

FORCED APPRECIATION

When investing in “value-add” multifamily assets, investors can rapidly create value and force appreciation through improving the physical asset, management quality, increasing revenue, and reducing expenses.

our mission

Enjoy the benefits of rental property ownership without the hassles or the huge downpayment.

Granite State Property Partners is a Limited Liability Corporation which purchases, manages, improves, rents out, and eventually sells multi-family properties in a geographic area centered around

Dover NH.

Investors purchase shares in the company, rather than the property directly, and benefit from the capital appreciation and rental income of those properties, without having to front all the money, and without the management hassle

typically associated with being a DIY landlord.

The properties are managed by the General Partners, who know what they are doing.

Granite State Property Partners invests in multifamily assets located in promising markets throughout New Hampshire. We look for opportunities that are located in C/B class neighborhoods within quality submarkets, where we have the opportunity to create value through renovations and management improvements.

Important: Granite State Property Partners Dover One fund is available for accredited investors only.

Three limiting beliefs that prevent investors from investing in real estate

Unaware of opportunities

Some investors may believe they don’t know enough about real estate or don’t have enough experience to invest.

Syndication solves this issue

No Time

Investing in real estate on your own requires significant time to locate deals, arrange financing, manage tenants, etc.

Syndication solves this issue.

lack of Significant capital

You don’t need hundreds of thousands of dollars to invest in real estate if you invest in a syndication. Investors can participate in our deals for as little as $50,000

What are some of the barriers to DIY ownership of multi-family properties?

High cost of entry– a typical multi-family home in Dover NH costs $600K – $650K

You have to put down 25% plus cover closing costs. The typical cash needed to close is about $170K. That prices a lot of people out of the market.

Owning a single building, even if you could afford it, exposes the owner to periodic vacancies, which can hurt when suddenly half or 1/3 of your rental income disappears. Vacancies matter a lot less when you instead own a share of many units.

Dealing with tenants and other issues is not for everyone.

There are no economies of scale when you do it yourself.

Why choose Granite State Property Partners?

Our General Partners boast nearly three decades of expertise in property ownership within the southern NH market, currently managing a collective portfolio of 33 units. Our mission is to democratize real estate ownership, empowering

individuals to embark on their own wealth-building journey.

By aligning our interests, we prioritize your success—our payout is entirely contingent upon your success.

TRUSTWORTHY

Our corporate attorney is

John Bosen, one of the most experienced and trusted real estate attorneys in Portsmouth.

LOCAL-OWNED

Both the General Partners live in Portsmouth NH. The properties we purchase will also be local, so you can drive by them yourself to see where your money is. This is unlike the typical REIT.

29 YEARS EXPERIENCE

One of our managers bought his first multi-family unit in 1995. He has since bought and sold dozens of properties and never lost money.

eCONOMIES OF SCALE

We have systems in place that make everything easier, cheaper, and faster than if you did it yourself.

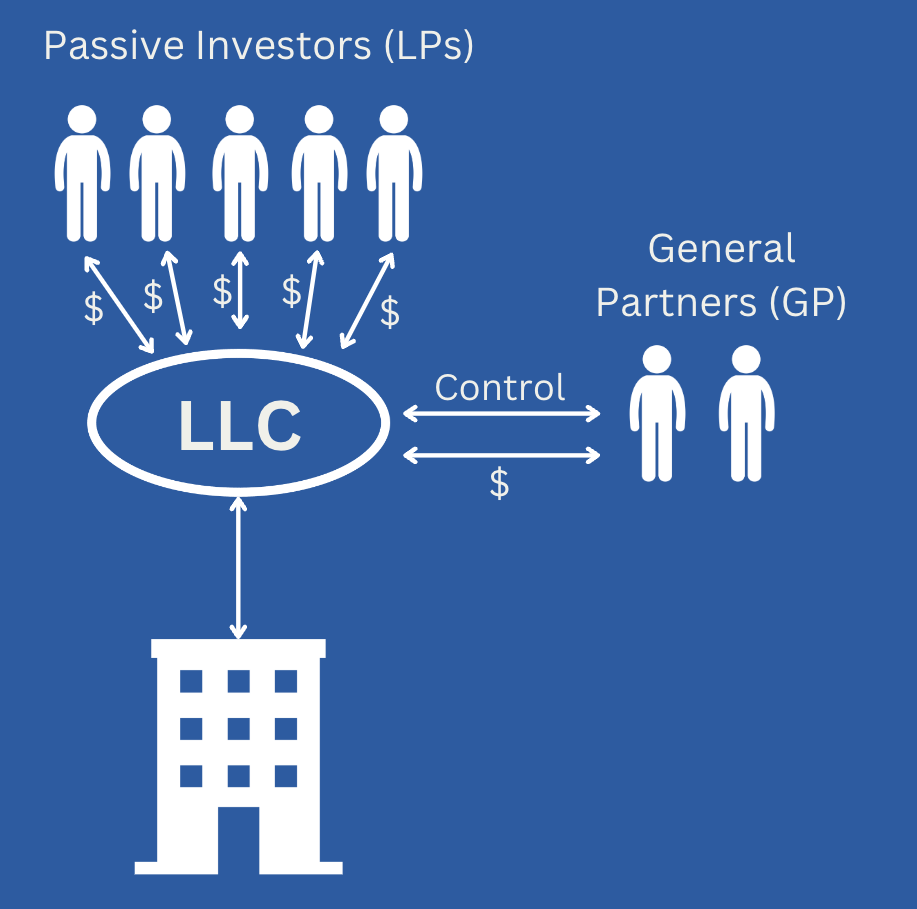

The Legal Structure – How it works

As an accredited investor, you purchase shares in an LLC, not the property directly. The LLC purchases and manages the buildings. Our attorney, Patrick Closson of

Mclane Middleton, handles all the paperwork to make sure everything is legit and investor rights are protected. Everything is spelled out in our Private Placement Memo and Operating Agreement.

Investors are Limited Partners in the LLC. There is another class of partner referred to as the General Partners. The

General Partners do the work, while Limited Partners are passive investors.

When it comes time to sell the properties, Limited Partners get their capital back first but as an incentive to get the General Partners to do the work, the capital gains are split. After the hold period, generally 10 years, one or more

of the properties will be sold and the limited partners and the general partners split the gain based on a formula specified in the Partner Agreement. This creates a strong incentive for the general partners to maximize the capital

gains, as they get nothing if the properties do not appreciate.

General Partners take a percentage of the rent as a management fee, and the rest is distributed to the limited partners quarterly, based on their equity percentage.

In ten years (hold time is approximate and subject to market conditions), every share (a $1,000 investment) should be worth $3,000 – $3,500– a 7.5% return– hopefully much more but of course we

cannot and do not guarantee any specific rate of return.

Call us now at

781/608-4060

to get your questions answered